Tapping into DAF Fundraising for Year-End & Beyond

As you plan your organization’s year-end efforts, consider incorporating a donor-advised fund (DAF) giving strategy—it could be the key to attracting new supporters and finishing the year strong!

With more donors turning to DAFs to enhance their philanthropic impact, integrating this approach into your strategy can help your nonprofit maximize contributions. DAF giving is new to many, so now’s the time to lean into learning more and educating your team!

What is a Donor-Advised Fund?

Let’s begin with a leading question, what is a DAF? Donor-advised funds (DAFs) are tax-advantaged accounts for charitable giving.

Mitch Stein, Head of Strategy at Chariot, compares donor-advised funds to a 401K or an HSA. “Those are accounts where you can put in tax-advantaged dollars,” Mitch explains. “You can invest them into the market like stocks and bonds so that they grow over time, and then you can use them at a future date.”

With DAFs, donors contribute cash or securities where they receive tax deductions and tax benefits immediately and then recommend grants to tax-exempt organizations.

Why are Donor-Advised Funds growing in popularity?

Donor-advised funds are generating increasing excitement. “The amount of people using donor-advised fund accounts has increased 2.3 times in five years,” Mitch says. Today, there are over 3 million people using DAF accounts.

When donors start giving from their DAF account, their annual contributions increase by 96%! In 2017, there were 19.7 billion dollars that came from DAFs to nonprofits, and in 2022, that number jumped to 50 billion. Projections show that DAFs will grant nearly 200 billion dollars per year by 2029!

Now that you’re aware of the growing momentum behind donor-advised funds, let’s break down the reasons why so many people are using them now.

- Accessible platforms and DAF structures: Platforms have become easier to set up and are no longer limited to wealthier individuals, making DAFs more accessible to a wider audience.

- Improvements to personal philanthropy: DAF accounts help individuals stay accountable and organized by ensuring that funds are dedicated solely to charitable giving,

- Core element of financial planning: Financial planners have improved DAF literacy and can better guide donors in setting up and managing an account.

- DAFs as an employee benefit: Major companies are making DAFs more accessible by offering their employees DAF account opportunities.

- Strong market performance: Performance of securities motivates donors to invest in DAF accounts, leveraging the financial benefits these accounts offer.

- Tax code changes: The 2017 tax code change significantly raised the standard deduction, leading many donors to stop itemizing their charitable contributions.

The Donor-Advised Fund Opportunity for Nonprofits

The growth of DAF has become “so big that it’s very difficult to ignore,” Mitch says.

The number of DAF donors has grown by 79%, with $230B currently sitting in DAF accounts ready to be distributed. $230 billion! Your nonprofit can multiply its revenue by planning a strategy around these impactful DAF opportunities.

Allocate time for your organization to become familiar with DAFs to better serve your audience. Early adopters will benefit the most, so prepare your fundraising team for continuous DAF growth.

Why do DAFs matter to nonprofits?

In a recent DAF fundraising study, more than half of nonprofits noticed a 200% increase in DAF revenue from 2019 to 2023. As a nonprofit, your mission is to generate donations that drive your cause forward. Donor-advised funds can be a powerful resource in helping you reach those goals.

Fidelity Charitable reports that about 50% of its donors are using DAF accounts. While donor-advised funds are becoming adopted by a broader audience, Mitch Stein claims they continue to be utilized by, “large, very wealthy donors, and they generally make very large gifts.”

If your organization can attract donations through donor-advised funds, you are more likely to receive greater contributions. DAF donors make 19x larger gifts than non-DAF donors, making them a critical source of revenue.

Why aren’t we raising more from DAFs?

Low familiarity or understanding can lead to donors not recognizing the potential of DAFs. “Donors could be giving more to your organization, but they don’t even know what a DAF is,” Mitch says. Providing resources to learn more about donor-advised funds could help your nonprofit maximize donations.

In addition to limited awareness of DAFs, the process of giving through a donor-advised fund can be time-consuming. To ensure your supporters enjoy a seamless giving experience, consider adopting user-friendly software to streamline the process.

DAFPay, a technology offered by Chariot, has revolutionized donor payment options. It’s a fast, secure, and reliable way to donate, seamlessly integrated into any nonprofit’s donation form. By bypassing traditional DAF platforms, DAFPay accelerates the impact of donations. For nonprofits, DAF gifts are automatically recorded in your database with complete donor information. With DAFPay’s gift tracker, you gain full transparency on the status of Donor-Advised Fund grants.

Though donor-advised funds have been around since 1930, they’re only now beginning to face legislative reform. Keep an eye on these developments to stay informed about giving opportunities that can further amplify your impact.

DAF Giving Strategy

You’re aware of DAFs, what they are, and why they’re important. Now, let’s explore what your organization can do to integrate DAF giving.

Market trends indicate nonprofits will be exploring and cultivating relationships with DAF donors in the future. The time to plan your DAF strategy is now!

Create a DAF strategy

To reach an active mindset, Mitch Stein breaks down a 4-step DAF strategy for nonprofits to implement.

- Education: Ensure your team, leadership, and fundraisers are familiar with the importance and benefits of DAFs to better communicate on the topic.

- Promotion: Remind donors how easily they can use their DAF for any donation, anytime. Emphasize DAF giving as an effective option and ensure information is readily available on your website. Use a multi-channel approach—email, physical mail, and event promotions—to keep DAF giving top of mind wherever donations are accepted.

- Improve DAF donor experience: Identify DAF donors and recognize them like you would a major donor prospect. Facilitate their giving process by having your nonprofit’s employer identification number accessible on your site.

- Data tracking: Segment DAF gifts from other types of donations and be sure to name the underlying provider rather than an individual financial advisor.

An active strategy will help your nonprofit leverage donor-advised fund philanthropy long term.

Tips for an effective DAF fundraising strategy

There are a few things to do as your nonprofit is planning a DAF fundraising strategy.

- Thank DAF donors: Verify that DAF owners receive proper recognition and appreciation – not just a tax receipt.

- Clarify DAFs cannot be used to “buy” anything: Clearly communicate that DAFs cannot be used for donations where the donor receives a personal benefit or in exchange for goods and services that provide a tangible return.

- Spell out “donor-advised fund”: Clarify the DAF acronym for individuals who may not be familiar with the term.

- Describe DAFs: Assume that not everyone is educated on donor-advised funds. It’s best to provide a brief sentence explaining what DAFs are in your promotions.

- Include DAFs in planned giving conversations: Spark the idea of naming your nonprofit as a beneficiary of a DAF account during legacy planning.

- Remind donors DAF gifts can be matched by their employer: Prompt donors to explore if their employer will match DAF disbursements through a matching gift program.

Implementing these strategies will help your nonprofit foster stronger relationships with a wider donor base and provide a cohesive understanding of DAFs within your organization.

DAF Fundraising for Year-End Giving

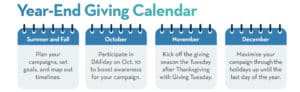

Let’s look at the calendar and the milestone dates when giving is at its peak. Nearly $3.1B is donated on Giving Tuesday, followed by December, when 30% of annual donations are made.

November and December have historically been the giving months you likely focus your

efforts on, but the end-of-year giving season has now expanded to include DAFDay in October.

DAFDay is a new kind of giving day to redefine how donor-advised funds are used and who uses them. It’s a single day dedicated to the DAF giving experience – building more opportunities for nonprofits.

Your organization can execute a DAF-specific campaign to get your donors familiar with DAF gifts leading up to the giving day and use the momentum to drive donations the rest of the year. Emphasizing the benefits of DAF gifts can motivate donors to act and help generate larger contributions for you.

Remember, your DAF strategy is not limited to year-end efforts. It is something your organization can consider for year-round goals!

Your Next Steps for DAF Fundraising

It’s important that your organization stays up-to-date with anything related to donor-advised funds — whether that be following DAF experts or visiting DAF-related blogs.

What can your team start doing today that will help now and in the future? Mitch offers a few suggestions on next steps:

Start talking about DAFs

As we mentioned above, it’s important to start conversations with your team, with donors, and your board, and anyone else you believe will benefit from learning about DAFs. You can start with your internal team and work outward to ensure a cohesive understanding.

DAF audit on your marketing

Review your website and communication materials to include donor-advised fund information. Mitch recommends that you do all this ahead of your year-end push to fully maximize your fundraising efforts.

Audit data practices

As the landscape of donor-advised funds continues to evolve rapidly, many nonprofits may struggle to stay fully compliant with tracking and reporting contributions. Implementing a system that identifies types of gifts can be beneficial. For instance, having a yes/no flag for “Is this a DAF gift?” can help better analyze DAF giving.

Aligning data tracking practices with your whole team will improve proper segmentation and analysis. In the long run, mindful strategies will help you engage and retain DAF donors.

Start your year-end campaign early

The best thing your organization can do is to plan early! Give yourself plenty of time to fully understand the ever-changing giving landscape, including DAF giving to make the most of year-end giving.

Planning early can even help you identify donor-advised fund donors sooner and give you more time to connect with them.

DAF Giving FAQ

Donor-advised funds can be overwhelming, especially when learning about them for the first time. With the help of Mitch Stein, we’ve provided answers to a few frequently asked questions surrounding donor-advised funds.

Who manages a DAF account?

When donors set up a donor-advised fund (DAF) account, they contribute funds and receive an immediate tax benefit. While the DAF entity then oversees the funds, the donor retains an important role as an advisor, guiding how the funds are distributed to organizations, ensuring their charitable intentions are fulfilled.

Do 501(c)3 organizations qualify for DAFs?

Yes, 501(c)3 organizations qualify for donor-advised funds. You must be in good standing with the IRS to be eligible.

Who benefits from a DAF?

Both donors and you benefit from donor-advised funds! Donors can increase their giving capacity with flexibility and tax efficiency. Organizations can significantly grow their impact and can achieve higher donor retention. In 2023, DAF donor retention was an average of 15% higher than non-DAF donors.

Learn More About DAF Fundraising and Year-End Strategies

Curious to learn more? Here are a few resources to strengthen your expertise on DAF giving and year-end fundraising efforts.

- DAF Decoded: Unlocking $230B for Your Cause featuring Mitch Stein: Tune into Raise Nation Radio to hear from Mitch Stein as he decodes all things about donor-advised funds.

- Go-To Plan To Maximize Your Nonprofit’s Year-End Potential: Let us help you plan your end-of-year giving campaign with a few tips to maximize your revenue.

- 2024 DAF Fundraising Report: Access the first-ever DAF Fundraising Report – a comprehensive study that will change how nonprofits approach their DAF giving strategy.

- DAF Day Information: Learn about a new kind of giving day!